The 20+RSI strategy

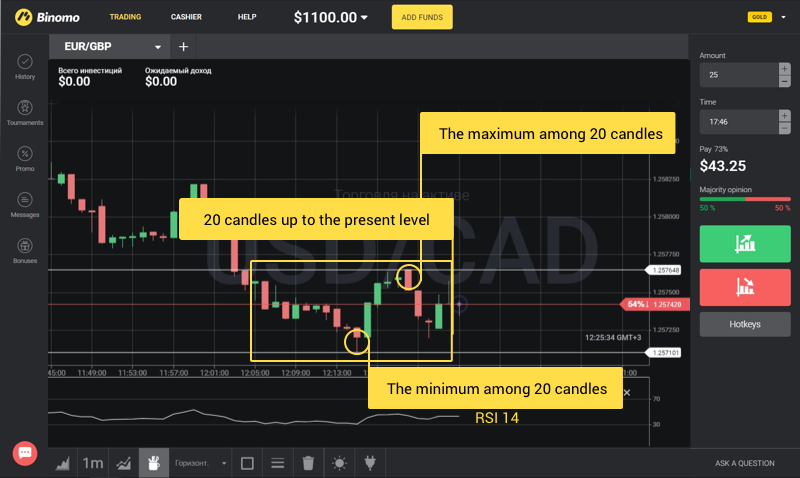

Did you know that asset prices often make turns the next day after a 20-day minimum or maximum? This is true for any scale, since the market repeats itself on all timeframes. The 20+RSI strategy is based on this principle: you need to count 20 candles back to predict a turning moment.

Setting up the template

Open the Binomo platform and select 1-minute timeframe on the candlestick chart.

Set the RSI indicator period at 14, with the overbought and oversold levels at 70 and 30 respectively.

Using the Rectangle tool, count 20 candles back (leaving out the current candle) and then find the minimum and maximum price levels within that segment.

IMPORTANT! The minimum and/or maximum level must be at least 4 candles away from the current level:

The current candle crossing a minimum or a maximum of the mentioned period is the signal to open a deal.

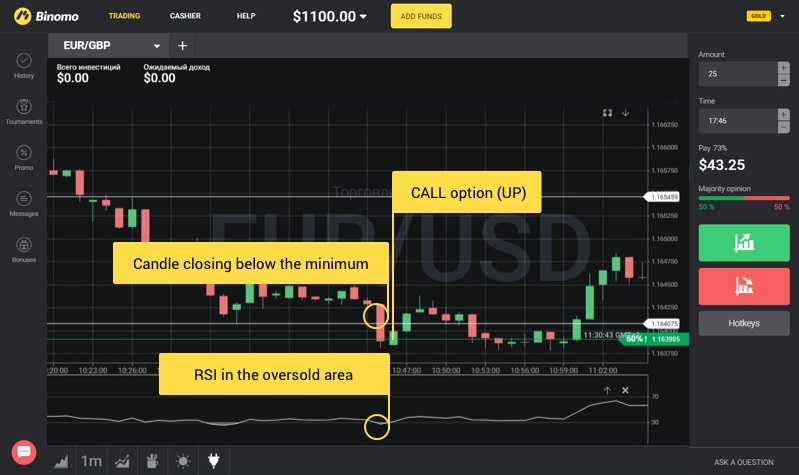

CALL options (UP) are bought when the current candle closes BELOW the marked minimum, and the RSI line is moving up within the oversold area:

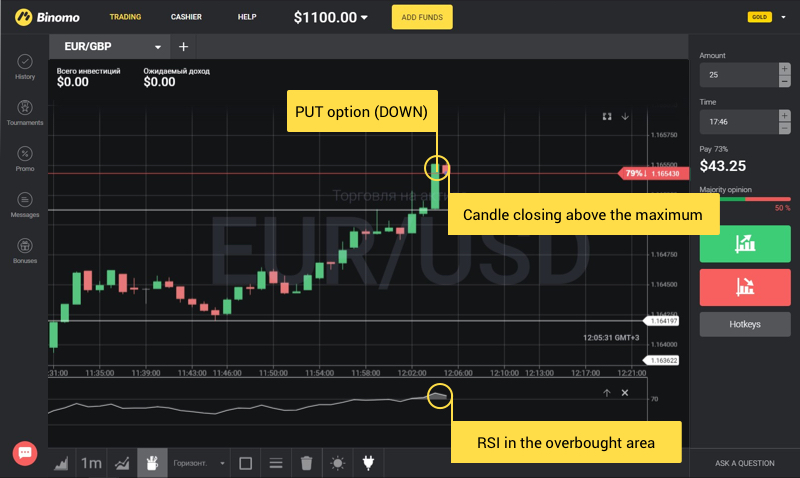

PUT options (DOWN) are bought when the current candle closes ABOVE the marked maximum, and the RSI line is moving down in the overbought area:

We do not recommend to open any deals if while the candle crosses the minimum or the maximum, the RSI indicator stays between the overbought and oversold levels.

Once an option contract is closed, repeat the whole procedure: count 20 candles back, find the minimum and maximum at least 4 candles away from the current level.

Recommendations

This strategy works best on a sideways market: at night (or in the morning), with the “flat” pairs such as CAD/CHF, AUD/CAD, EUR/GBP and Gold.

Choose short-term contracts (up to 3 minutes).

Do not trade an hour before and after the release of important news!